That’s a great question, I see many patients that want to come to our office but don’t have their vision benefit with us. That means in many cases that we are an out-of-network provider. Usually you can come to our office for vision care and receive a partial reimbursement from your vision plan. If we are not on your vision plan you can still submit your claim to your benefits department for a reimbursement to you from your plan. You would pay us for our exam services and materials. We will give you a superbill aka billing statement and codes which will allow your benefits department and vision care plan to determine how much they would reimburse you for our services. It is still advised that you check this out in advance of using our services.

Author Archives: mfamilyeyecare

Dr. Maredia Acquires a Fundus Camera

Recently, we purchased a Fundus Camera for our practice. Without going into a technical discussion of exactly what a Fundus Camera does, it essentially takes a photo of the back of the eye. The highly specialized image documents a baseline image that can be used for comparison over time. As we age and our bodies change, so do our eyes, which is why it is great to have a standard to compare by and see any changes over time. In addition to setting a standard, this screening can be used to diagnose potential eye diseases.

While the economy is down, it might not make sense to most optometrists to make capital equipment purchases. However, Dr. Maredia feels that a Fundus Photo screen is an excellent compliment to a comprehensive eye examination. We strive to be the best eye doctors in San Antonio and in order to accomplish this, we must have the right tools to do the job.

Please call us at 210-826-3937 to find out more details about this new equipment.

Understanding Vision Plans and Coverage

The options available to you in vision plans can be a little daunting. If you’ve chosen your

vision insurance through your employer, your HR department and the insurance company literature—and websites—are a good place to start to understand what your vision insurance plan does and does not cover.

In general, there are two types of vision insurance plans:

Vision Benefits Package

Often purchased as an addition to traditional employer-provided healthcare, this type of vision insurance includes a fixed set of benefits related to eye health and maintenance, such as routine eye exams and testing, discounts for corrective eyewear, even benefits that reduce the cost of eye surgery. Vision insurance like this typically includes a “network” of participating eyecare professionals who have agreed to honor the plan particulars. Continue reading

Where can I get Vision Insurance?

Group vision insurance can be obtained through your company, association, school district, etc., or through a government program such as Medicare or Medicaid. Also, as an individual, you have the option of purchasing your own vision benefit plan.

Vision insurance is often a value-added benefit included in indemnity health insurance plans, health maintenance organization (HMO) plans and plans offered by preferred provider organizations (PPOs):

- Indemnity health insurance is traditional insurance, which allows policyholders to access medical providers of their choice.

- An HMO is a group of healthcare professionals – doctors, laboratories, hospitals and the like – employed to provide health care services to plan members at discounted rates. Usually, health plan members are required to access health care only from HMO providers.

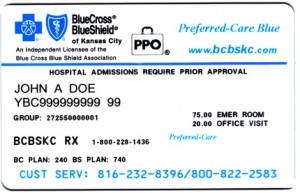

- A PPO is a network of healthcare professionals organized to provide healthcare services to plan members at a fixed rate below “retail” prices. Plan members may opt to access out-of-network providers, but usually at a greater cost.